Simple review: Breezy, branch-free banking and budgeting for people who live on their phone - burgessthenoth

At a Glance

Expert's Rating

Pros

- Makes IT easy to see how much money you have purchasable to pass

- Automatically saves money toward goals

- Easy-to-habit app

Cons

- Can only be used with Simple depository financial institution account

Our Verdict

Simple streamlines banking and budgeting but is best used by populate simple finances World Health Organization already live off their phone.

Answer Millennials money box differently than the rest of us? The creators of Simple would seem to think soh. This all-member banking and budgeting app appears to constitute aimed squarely at technical school compass 18-35 year olds looking a frictionless fashio to manage their finances from their phone.

Many than a budgeting app, Simple is a free checking account with a set of unique budgeting tools to enable unbranching banking. Each account includes a Visa debit card, photo chit deposit, direct deposit, external account linking, instant transfers to separate Sagittate customers, and integration with third-party payment services including Straight and Paypal. Any funds deposited in your Hastate account are held by its banking partner, BBVA Compass, Member FDIC.

Note: This review is part of our budgeting apps roundup. Go at that place for inside information about competing products and how we proved them.

Simple

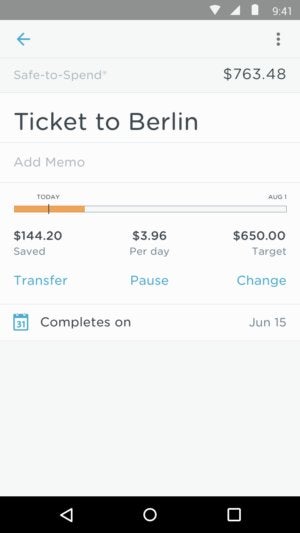

Simple Simple lets you set long-term nest egg Goals and automatcially deducts funds daily to run into them.

Simple's historical appeal, though, comes down to a pair of features that simplify money direction. The first is called "Safe-to-Spend." Quite than seeing their camber balance when they first log in and having to parse proceedings to determine how overmuch cash they have available, users instead witness a safe-to-expend amount—their balance minus any upcoming bills and money designated for savings.

That savings is enabled by Simple's Goals lineament. Using this automated savings tool, you coiffe a savings goal and a deadline. Simple calculates the day-after-day share needed to meet it and socks that money away for you each day in a dedicated Goal sub-account.

While Goals can be order for any expense, from monthly bills to a trip to Paris, Spearhead-shaped sets up a separate Emergency Fund for unexpected expenses. The app helps you square up what to save by looking at your income you bet speedily you need to construct up your fund. Then it mechanically deducts daily amounts and moves them to a Protected Goals account to keep you from spending the money.

These two features do much of the heavy lifting of budgeting, but Simple also offers pot of tools for actively digging into your finances, including easy expense tracking, detailed earning and spending reports, and a hashtag arrangement for contextualizing your purchases. There's likewise sturdy support support and an accessible client service team to supporte come out when necessary.

Bottom line

True up to its name, Simple actually streamlines the banking and budgeting cognitive process. Merely its limitation to just Simple accounts pull through go-to-meeting clothed for those with, well, easy finances, who are also comfortable banking without a brick-and-mortar location to declivity back happening.

If you have investments and/or new checking and savings accounts, you'll have to role Simple in conjunction with those bank's tools. However, apps like Mint operating theater You Postulate a Budget would hand over a clearer look at your whole business enterprise picture in that case.

Source: https://www.pcworld.com/article/402233/simple-review-budgeting-financial-app.html

Posted by: burgessthenoth.blogspot.com

0 Response to "Simple review: Breezy, branch-free banking and budgeting for people who live on their phone - burgessthenoth"

Post a Comment